Recently some payment processors have rolled out a “new” pricing platform and are touting exceptionally low rates—Tiered Pricing. This type of pricing platform is in fact not new at all but rather an old pricing scheme that we had hoped had seen its end years ago. Tiered pricing is opaque, expensive and is the vehicle for many of the hidden fees that plague the credit card processing industry.

What is Tiered Pricing?

Tiered pricing is a merchant account rate structure that credit card processors use to assess charges. It is also referred to as bundled pricing because it allows processors to group interchange fees into general rate tiers of their choice.

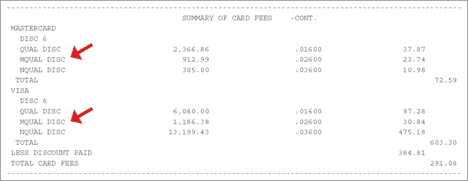

Bundled or tiered pricing can be identified in a couple of different ways, the easiest of which is to look for the qualified, mid-qualified and non-qualified rate tiers after which the pricing model is named. The sample statement below, taken from our article about how to read an Intuit merchant statement, provides a quintessential representation of how tiered pricing is shown on a merchant account statement.

The terms “qualified,” “mid-qualified” and “non-qualified” are often abbreviated. Be sure to look for variations of the terms when identifying tiered pricing. For example, the terms are abbreviated on Intuit merchant services statement above as “qual,” “mqual” and “nqual,” respectively.

In the absence of terms “qualified,” “mid-qualified” and “non-qualified,” tiered pricing can also be identified by a consistent set of rates across all card brands. These rates will generally be in the area of 1.65% – 3.25% but may be higher or lower depending on how many tiers a processor is using. The sample statements below show examples of tiered pricing identified through consistent rates across all card brands.

How Tiered Pricing Works

Tiered pricing allows a credit card processor to group numerous interchange fees into three or more general pricing tiers of its choice.

Interchange Fees

Before you can understand how tiered pricing works, you first have to have a basic understanding of interchange. Interchange rates are essentially wholesale processing rates that are paid to the banks that issue credit cards. For example, if a customer uses her Bank of America credit card to purchase gas, the gas station will pay an interchange fee to Bank of America through their credit card processor.

There are numerous different interchange fee categories. However, they are the same for all businesses and are determined on a per-transaction basis. The interchange category that a transaction will be placed into is not known until the transaction is actually processed. Several variables such as card type (credit or debit), card category (reward, standard, consumer, etc), transaction method (keyed, swiped, etc.) and more all have an impact on which interchange category a transaction fall into.

All combined, Visa, MasterCard and Discover have several hundred different interchange categories, so it’s not uncommon for a business to pay twenty or more different interchange rates throughout a typical month of processing.

Why Tiered Pricing is Bad

The only benefit to tiered pricing is that it presents rates and fees in a simple, easy to read format. However, the simplicity of this pricing model makes it opaque and expensive.

It’s Expensive

Although processors sell the “qualified” rate it is seldom the case that an accepted card actually processes at the advertised rate. Businesses save between 40% – 50% on credit card processing charges by switching to a more competitive pricing model.

Conceals the True Cost of Processing

A processor doesn’t disclose the actual cost. Instead, only the processor’s qualified, mid-qualified and non-qualified rates are visible. By hiding interchange fees, a business is never shown the actual cost of its processing. Thus, the processor has the ability to charge markups that are often exorbitant.

Allows Processor to Keep Refund Credits

When a business refunds a customer for a credit or debit card transaction fees, the business is supposed to receive a credit for a portion of the interchange fees paid on the original transactions. For example, an online business receives a credit of 2.05% on interchange fees for a returned transaction involving a traditional consumer credit card.

Since interchange categories are bundled on tiered pricing, interchange credits are not passed to businesses. Instead, processors simply keep interchange credits as additional revenue.

Inconsistent Markup

As you can see from the two example tables above, tiered pricing results in a different markup for each individual interchange category. The sporadic markup and inconsistent qualification associated with tiered pricing makes it impossible to compare among processors.

Lost Durbin Savings

The Durbin Amendment that took effect on October, 1 2011 capped the interchange fee that large banks could charge at just 0.05% plus $0.21. The law capped interchange fees at the card-issuer level, not at the processor level.

This means that any business being billed via tiered pricing will pay its processor’s qualified rate instead of the newly capped rate of just 0.05%. The per-transaction loss is substantial when considering that qualified rates are typically 1.65% or higher.

Those of us who have been in the industry were surprised—to say the least—to see some processors reach back into the past and dust off this antiquated pricing platform and sell it to merchants. Years ago small and medium-sized businesses only had the option of tiered pricing. The most reputable processors have left this pricing scheme in the past right where it belongs!

0 Comments